- ACQUISITION OF HOLDINGS 134.27

- ADDED VALUE 131.49

- AGENCY THEORY 331.47

- ASSETS ALLOCATION 134.87

- BANK 335.67

- BANK CREDIT 131.50

- BEHAVIORAL FINANCE 134.44

- BENEFIT 131.48

- BILL OF EXCHANGE 131.40

- BORROWING 131.91

- BUSINESS ASSETS 322.17

- CAPITAL 131.87

- CAPITAL EXPENDITURE 332.25

- CAPITAL THEORY 331.38

- CASH ASSETS 131.24

- CASH MANAGEMENT 131.14

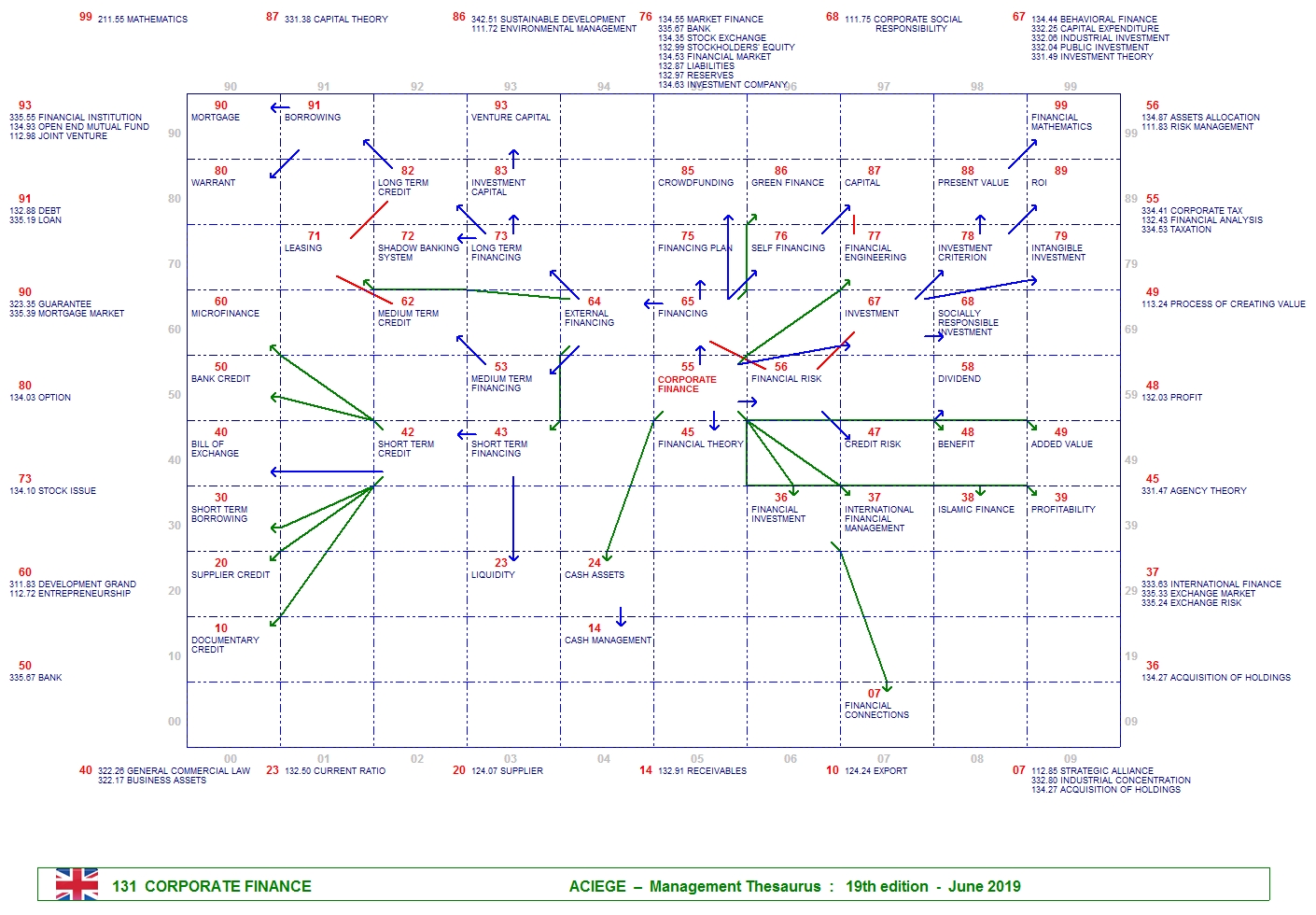

- CORPORATE FINANCE 131.55

- CORPORATE SOCIAL RESPONSIBILITY 111.75

- CORPORATE TAX 334.41

- CREDIT RISK 131.47

- CROWDFUNDING 131.85

- CURRENT RATIO 132.50

- DEBT 132.88

- DEVELOPMENT GRAND 311.83

- DIVIDEND 131.58

- DOCUMENTARY CREDIT 131.10

- ENTREPRENEURSHIP 112.72

- ENVIRONMENTAL MANAGEMENT 111.72

- EXCHANGE MARKET 335.33

- EXCHANGE RISK 335.24

- EXPORT 124.24

- EXTERNAL FINANCING 131.64

- FINANCIAL ANALYSIS 132.43

- FINANCIAL CONNECTIONS 131.07

- FINANCIAL ENGINEERING 131.77

- FINANCIAL INSTITUTION 335.55

- FINANCIAL INVESTMENT 131.36

- FINANCIAL MARKET 134.53

- FINANCIAL MATHEMATICS 131.99

- FINANCIAL RISK 131.56

- FINANCIAL THEORY 131.45

- FINANCING 131.65

- FINANCING PLAN 131.75

- GENERAL COMMERCIAL LAW 322.26

- GREEN FINANCE 131.86

- GUARANTEE 323.35

- INDUSTRIAL CONCENTRATION 332.80

- INDUSTRIAL INVESTMENT 332.06

- INTANGIBLE INVESTMENT 131.79

- INTERNATIONAL FINANCE 333.63

- INTERNATIONAL FINANCIAL MANAGEMENT 131.37

- INVESTMENT 131.67

- INVESTMENT CAPITAL 131.83

- INVESTMENT COMPANY 134.63

- INVESTMENT CRITERION 131.78

- INVESTMENT THEORY 331.49

- ISLAMIC FINANCE 131.38

- JOINT VENTURE 112.98

- LEASING 131.71

- LIABILITIES 132.87

- LIQUIDITY 131.23

- LOAN 335.19

- LONG TERM CREDIT 131.82

- LONG TERM FINANCING 131.73

- MARKET FINANCE 134.55

- MATHEMATICS 211.55

- MEDIUM TERM CREDIT 131.62

- MEDIUM TERM FINANCING 131.53

- MICROFINANCE 131.60

- MORTGAGE 131.90

- MORTGAGE MARKET 335.39

- OPEN END MUTUAL FUND 134.93

- OPTION 134.03

- PRESENT VALUE 131.88

- PROCESS OF CREATING VALUE 113.24

- PROFIT 132.03

- PROFITABILITY 131.39

- PUBLIC INVESTMENT 332.04

- RECEIVABLES 132.91

- RESERVES 132.97

- RISK MANAGEMENT 111.83

- ROI 131.89

- SELF FINANCING 131.76

- SHADOW BANKING SYSTEM 131.72

- SHORT TERM BORROWING 131.30

- SHORT TERM CREDIT 131.42

- SHORT TERM FINANCING 131.43

- SOCIALLY RESPONSIBLE INVESTMENT 131.68

- STOCK EXCHANGE 134.35

- STOCK ISSUE 134.10

- STOCKHOLDERS' EQUITY 132.99

- STRATEGIC ALLIANCE 112.85

- SUPPLIER 124.07

- SUPPLIER CREDIT 131.20

- SUSTAINABLE DEVELOPMENT 342.51

- TAXATION 334.53

- VENTURE CAPITAL 131.93

- WARRANT 131.80

- 07 STRATEGIC ALLIANCE 112.85

- 07 INDUSTRIAL CONCENTRATION 332.80

- 07 ACQUISITION OF HOLDINGS 134.27

- 10 EXPORT 124.24

- 14 RECEIVABLES 132.91

- 20 SUPPLIER 124.07

- 23 CURRENT RATIO 132.50

- 37 INTERNATIONAL FINANCE 333.63

- 37 EXCHANGE MARKET 335.33

- 37 EXCHANGE RISK 335.24

- 40 GENERAL COMMERCIAL LAW 322.26

- 40 BUSINESS ASSETS 322.17

- 45 AGENCY THEORY 331.47

- 48 PROFIT 132.03

- 49 PROCESS OF CREATING VALUE 113.24

- 50 BANK 335.67

- 55 CORPORATE TAX 334.41

- 55 FINANCIAL ANALYSIS 132.43

- 55 TAXATION 334.53

- 56 ASSETS ALLOCATION 134.87

- 56 RISK MANAGEMENT 111.83

- 60 DEVELOPMENT GRAND 311.83

- 60 ENTREPRENEURSHIP 112.72

- 67 BEHAVIORAL FINANCE 134.44

- 67 CAPITAL EXPENDITURE 332.25

- 67 INDUSTRIAL INVESTMENT 332.06

- 67 PUBLIC INVESTMENT 332.04

- 67 INVESTMENT THEORY 331.49

- 68 CORPORATE SOCIAL RESPONSIBILITY 111.75

- 73 STOCK ISSUE 134.10

- 76 MARKET FINANCE 134.55

- 76 STOCK EXCHANGE 134.35

- 76 STOCKHOLDERS' EQUITY 132.99

- 76 FINANCIAL MARKET 134.53

- 76 LIABILITIES 132.87

- 76 RESERVES 132.97

- 76 INVESTMENT COMPANY 134.63

- 80 OPTION 134.03

- 86 SUSTAINABLE DEVELOPMENT 342.51

- 86 ENVIRONMENTAL MANAGEMENT 111.72

- 87 CAPITAL THEORY 331.38

- 90 GUARANTEE 323.35

- 90 MORTGAGE MARKET 335.39

- 91 DEBT 132.88

- 91 LOAN 335.19

- 93 FINANCIAL INSTITUTION 335.55

- 93 OPEN END MUTUAL FUND 134.93

- 93 JOINT VENTURE 112.98

- 99 MATHEMATICS 211.55

- - Acceptance credit 131.65

- - Bills receivable 131.40

- - Capital budgeting 131.78

- - Cash flow forecast 131.14

- - Chief Financial Officer 131.55

- - Core satellite 131.36

- - Credit 131.65

- - Credit between firms 131.42

- - Draft 131.40

- - Financial management 131.55

- - MAPI method 131.78

- - Microcredit 131.60

- - Mortgage loan 131.90

- - Profitability of an investment 131.89

- - Rate of return 131.39

- - Recovery 131.14

- - Return on investment 131.89

- - SRI 131.68

- - Shadow banking 131.72

- - Source of financing 131.65

- - Statement of source and application of funds 131.75

- - Unpaid 131.40

- - Value at risk 131.56

- - Value updating 131.88