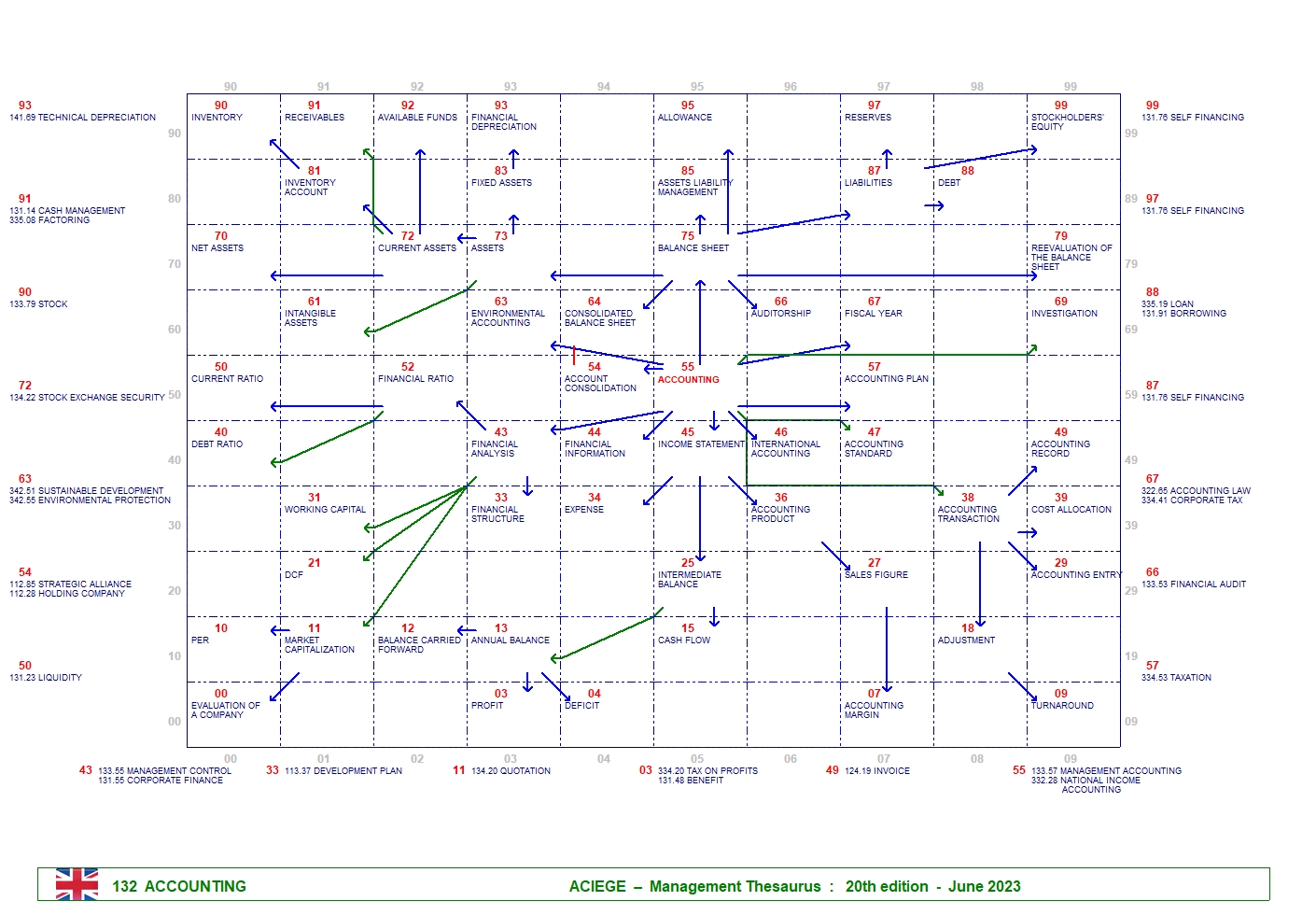

- ACCOUNT CONSOLIDATION 132.54

- ACCOUNTING 132.55

- ACCOUNTING ENTRY 132.29

- ACCOUNTING LAW 322.65

- ACCOUNTING MARGIN 132.07

- ACCOUNTING PLAN 132.57

- ACCOUNTING PRODUCT 132.36

- ACCOUNTING RECORD 132.49

- ACCOUNTING STANDARD 132.47

- ACCOUNTING TRANSACTION 132.38

- ADJUSTMENT 132.18

- ALLOWANCE 132.95

- ANNUAL BALANCE 132.13

- ASSETS 132.73

- ASSETS LIABILITY MANAGEMENT 132.85

- AUDITORSHIP 132.66

- AVAILABLE FUNDS 132.92

- BALANCE CARRIED FORWARD 132.12

- BALANCE SHEET 132.75

- BENEFIT 131.48

- BORROWING 131.91

- CASH FLOW 132.15

- CASH MANAGEMENT 131.14

- CONSOLIDATED BALANCE SHEET 132.64

- CORPORATE FINANCE 131.55

- CORPORATE TAX 334.41

- COST ALLOCATION 132.39

- CURRENT ASSETS 132.72

- CURRENT RATIO 132.50

- DCF 132.21

- DEBT 132.88

- DEBT RATIO 132.40

- DEFICIT 132.04

- DEVELOPMENT PLAN 113.37

- ENVIRONMENTAL ACCOUNTING 132.63

- ENVIRONMENTAL PROTECTION 342.55

- EVALUATION OF A COMPANY 132.00

- EXPENSE 132.34

- FACTORING 335.08

- FINANCIAL ANALYSIS 132.43

- FINANCIAL AUDIT 133.53

- FINANCIAL DEPRECIATION 132.93

- FINANCIAL INFORMATION 132.44

- FINANCIAL RATIO 132.52

- FINANCIAL STRUCTURE 132.33

- FISCAL YEAR 132.67

- FIXED ASSETS 132.83

- HOLDING COMPANY 112.28

- INCOME STATEMENT 132.45

- INTANGIBLE ASSETS 132.61

- INTERMEDIATE BALANCE 132.25

- INTERNATIONAL ACCOUNTING 132.46

- INVENTORY 132.90

- INVENTORY ACCOUNT 132.81

- INVESTIGATION 132.69

- INVOICE 124.19

- LIABILITIES 132.87

- LIQUIDITY 131.23

- LOAN 335.19

- MANAGEMENT ACCOUNTING 133.57

- MANAGEMENT CONTROL 133.55

- MARKET CAPITALIZATION 132.11

- NATIONAL INCOME ACCOUNTING 332.28

- NET ASSETS 132.70

- PER 132.10

- PROFIT 132.03

- QUOTATION 134.20

- RECEIVABLES 132.91

- REEVALUATION OF THE BALANCE SHEET 132.79

- RESERVES 132.97

- SALES FIGURE 132.27

- SELF FINANCING 131.76

- STOCK 133.79

- STOCK EXCHANGE SECURITY 134.22

- STOCKHOLDERS' EQUITY 132.99

- STRATEGIC ALLIANCE 112.85

- SUSTAINABLE DEVELOPMENT 342.51

- TAX ON PROFITS 334.20

- TAXATION 334.53

- TECHNICAL DEPRECIATION 141.69

- TURNAROUND 132.09

- WORKING CAPITAL 132.31

- 03 TAX ON PROFITS 334.20

- 03 BENEFIT 131.48

- 11 QUOTATION 134.20

- 33 DEVELOPMENT PLAN 113.37

- 43 MANAGEMENT CONTROL 133.55

- 43 CORPORATE FINANCE 131.55

- 49 INVOICE 124.19

- 50 LIQUIDITY 131.23

- 54 STRATEGIC ALLIANCE 112.85

- 54 HOLDING COMPANY 112.28

- 55 MANAGEMENT ACCOUNTING 133.57

- 55 NATIONAL INCOME ACCOUNTING 332.28

- 57 TAXATION 334.53

- 63 SUSTAINABLE DEVELOPMENT 342.51

- 63 ENVIRONMENTAL PROTECTION 342.55

- 66 FINANCIAL AUDIT 133.53

- 67 ACCOUNTING LAW 322.65

- 67 CORPORATE TAX 334.41

- 72 STOCK EXCHANGE SECURITY 134.22

- 87 SELF FINANCING 131.76

- 88 LOAN 335.19

- 88 BORROWING 131.91

- 90 STOCK 133.79

- 91 CASH MANAGEMENT 131.14

- 91 FACTORING 335.08

- 93 TECHNICAL DEPRECIATION 141.69

- - Accounting income 132.13

- - Annual report 132.44

- - Business report 132.44

- - Cash in hand 132.15

- - Certified public accountants firm 132.69

- - Comparison between firms 132.00

- - Corporate rating 132.00

- - Discounted cash flow 132.21

- - Double entry bookkeeping 132.55

- - Fair value 132.00

- - Financial account 132.75

- - Financial accounting 132.55

- - Financial report 132.44

- - Fixed assets account 132.83

- - Green accounting 132.63

- - Liquidity ratio 132.50

- - Long term capital account 132.87

- - Operating income 132.25

- - Price earning ratio 132.10

- - Profit margin 132.07

- - Rating 132.00

- - Realizable and available 132.92

- - Shareholders' capital 132.99

- - Stock value 132.11

- - Term of payment 132.91

- - Value of a company 132.00