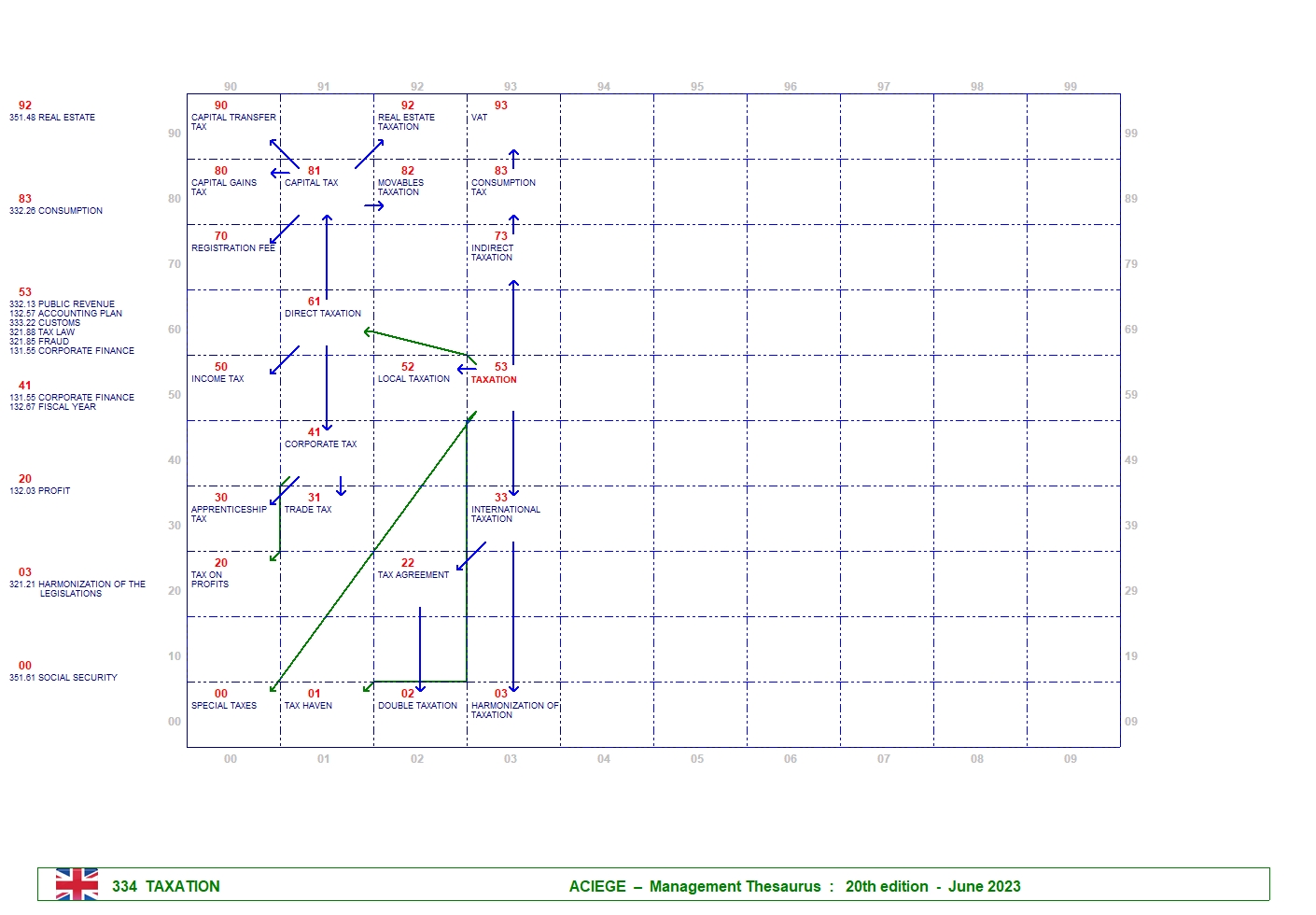

- ACCOUNTING PLAN 132.57

- APPRENTICESHIP TAX 334.30

- CAPITAL GAINS TAX 334.80

- CAPITAL TAX 334.81

- CAPITAL TRANSFER TAX 334.90

- CONSUMPTION 332.26

- CONSUMPTION TAX 334.83

- CORPORATE FINANCE 131.55

- CORPORATE TAX 334.41

- CURRENCY 335.53

- CUSTOMS 333.22

- DIRECT TAXATION 334.61

- DOUBLE TAXATION 334.02

- FISCAL YEAR 132.67

- FRAUD 321.85

- HARMONIZATION OF TAXATION 334.03

- HARMONIZATION OF THE LEGISLATIONS 321.21

- INCOME TAX 334.50

- INDIRECT TAXATION 334.73

- INTERNATIONAL TAXATION 334.33

- LOCAL TAXATION 334.52

- MONETARY INTEGRATION 335.30

- MOVABLES TAXATION 334.82

- PROFIT 132.03

- PUBLIC REVENUE 332.13

- REAL ESTATE 351.48

- REAL ESTATE TAXATION 334.92

- REGISTRATION FEE 334.70

- SOCIAL SECURITY 351.61

- SPECIAL TAXES 334.00

- TAX AGREEMENT 334.22

- TAX HAVEN 334.01

- TAX LAW 321.88

- TAX ON PROFITS 334.20

- TAXATION 334.53

- TRADE TAX 334.31

- VAT 334.93

- 00 SOCIAL SECURITY 351.61

- 03 MONETARY INTEGRATION 335.30

- 03 HARMONIZATION OF THE LEGISLATIONS 321.21

- 20 PROFIT 132.03

- 41 CORPORATE FINANCE 131.55

- 41 FISCAL YEAR 132.67

- 53 PUBLIC REVENUE 332.13

- 53 ACCOUNTING PLAN 132.57

- 53 CUSTOMS 333.22

- 53 TAX LAW 321.88

- 53 FRAUD 321.85

- 53 CURRENCY 335.53

- 83 CONSUMPTION 332.26

- 92 REAL ESTATE 351.48

- - Assessment 334.53

- - Tax 334.53

- - Tax on luxury goods 334.83

- - Tax planning 334.53

- - Transfer tax 334.90

- - Value added tax 334.93